Many companies are under tremendous financial pressure due to the COVID-19 virus. We sat down to figure out what we can do to help and came up with 4 ways of how we can reduce cost and increase liquidity in the short term for a company. We are posting these 4 ideas in a blog series and in this blog post, we will present the first idea to improve your financials – hardware refresh. Most importantly, we will put numbers on such a refreshment which would cheer up many CFO’s today.

#1 – Hardware refresh in your datacenter

With a depreciation cycle of 36 months, you’re looking at a 33% replacement of servers and storage in your datacenter this year. Now is a good time to challenge the default decision to replace those servers with new ones and consider cloud instead. Here are a few reasons why:

- You don’t have to make the capital expenditure upfront which will have a positive impact on your cashflow and your balance sheet.

- You will lower your cost by an average of 30-40%

- You don’t have to buy capacity to last for 36 months with low utilization the first couple of years.

- You pay for what you use and you can scale up or down in capacity by pressing a button.

- You are making the inevitable move to cloud sooner than later

Example – a company with 300 servers, 50TB of storage

In this example, we’re looking at a company with a total of 300 servers and 50 Terabyte of storage running in a datacenter or a co-location. They have a depreciation cycle of 36 months which means that they normally refresh 33% of the estate each year, in this case 99 servers + 16TB of storage.

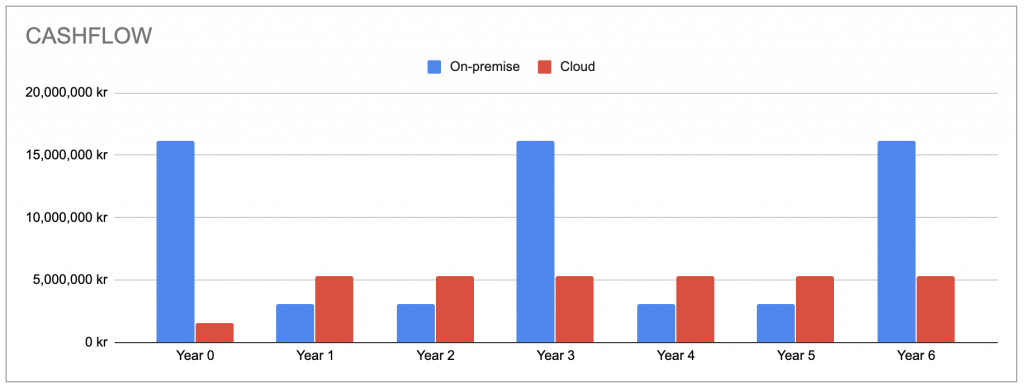

The graph shows a cashflow comparison between replacing the hardware compared to running the same workload in the cloud. The greatest benefit from a financial perspective becomes obvious in the graph, you don’t have the capital expenditure upfront when using cloud. This company is looking at an upfront cost of 16.1MSEK. Instead of spending 16MSEK in refreshing hardware, it will do more good as free cash and liquidity.

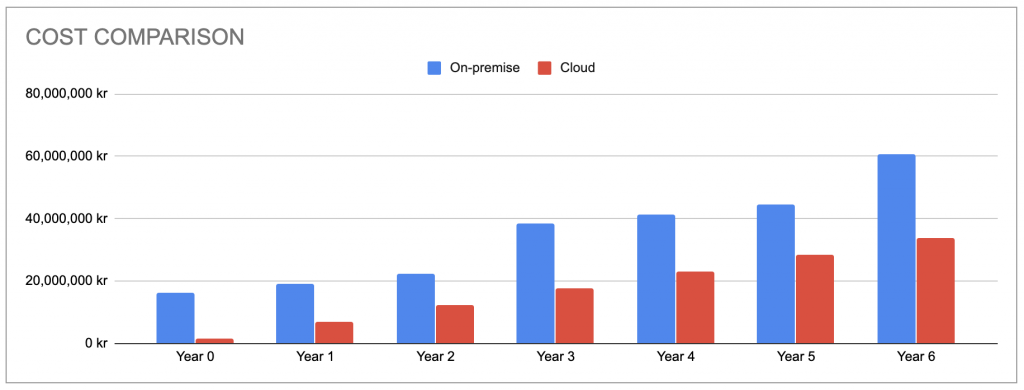

Another observation is that cloud seems more expensive on a yearly basis and that’s true. However, when considering the upfront costs, the accumulated savings are considerable, see graph below. Beside keeping 16MSEK in the balance sheet, this company would save 4.5MSEK per year or 27MSEK in 6 years by using cloud instead of refreshing the servers.

In this example, the customer are paying for the transition project and the cost is included in the business case. Most of the time, AWS offers generous fundings to reduce the so called “migration bubble”, which is the time when you run the workload both on-premise and in cloud during the migration project.

There are of course a lot of ifs and buts in any calculation and the numbers are just interesting if you can identify yourself in them. We have created a template for helping companies calculate a comparison between doing a hardware refresh versus cloud. We can customize most of the data to simulate your specific prerequisites to make it as accurate as possible.

Please contact me or any of my colleagues if you would like to do the exercise for your company, we’re here to help.

Stay tuned for more examples of how we can help you reduce costs and increase liquidity.