Many companies are under tremendous financial pressure due to the COVID-19 virus. We sat down to figure out what we can do to help and came up with 4 ways of how we can reduce cost and increase liquidity in the short term for a company. We are posting these 4 ideas in a blog series and in this blog post, we will present the second way to improve your financials – replace your integration plattform.

#2 – [ insert integration product here ] replace

Every organization needs to connect data between applications and databases to support their business processes. There are a lot of ways of solving the integration need but many companies have bought an integration platform from one or more of the major product vendors in the market such as Microsoft Biztalk, Tibco, Mulesoft, IBM Websphere etc. If you’re one of them, we have good news for you and your CFO.

According to Radar Group, who made a survey of 200 Swedish companies a few years back, integration is a hidden cost bomb. On average, companies spend 140 000 SEK in maintenance cost per year and per integration. On average, a company with 300 employees have 50 integrations if you’re in the retail or in the distribution sector, 70 integrations if you’re in the manufacturing sector according to the survey. The cost of integration is substantial.

Microsoft Biztalk

If you’re running your integrations on Microsoft Biztalk, you’re probably considering an upgrade from version 2016 to 2020 if you haven’t already upgraded. Upgrades are often a major effort in time, resources and cost but are of course not unique for Microsoft, it’s part of using any commercial software. If you’re planning an upgrade, you have much to gain by challenging that upgrade and consider cloud instead.

Example – a company with 100 integrations

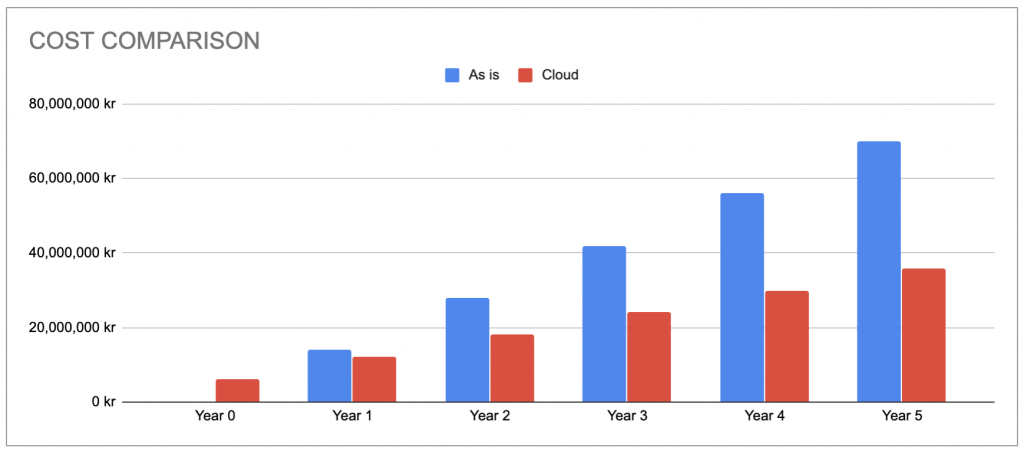

In this example, we’re looking at a company with 100 integrations. We’re not including an upfront cost of an upgrade so again, if you’re planning an upgrade you will have an even better business case.

We’re comparing the existing maintenance cost with a managed serverless integration service from us. The business case includes the transformation cost of rebuilding all integrations and deploying them in AWS. Monitoring, incident and problem management is included in the price to be fully comparable. Hardware, licenses and High Availability are included as well.

Year 0 represents the investment year and in this case, it’s the transformation cost of rebuilding the existing integrations to cloud. There are no investments for “as is” if you’re not planning for an upgrade.

This company would have a yearly cost of 14MSEK to manage their existing integrations, all included except external consultants for management and monitoring. They would need to invest 6MSEK in transformation costs and the recurring cost for the cloud solution would be 6MSEK per year, all included. The accumulated cost as-is would be 70MSEK over 5 years compared to cloud which would be 36MSEK including the transformation cost of 6MSEK.

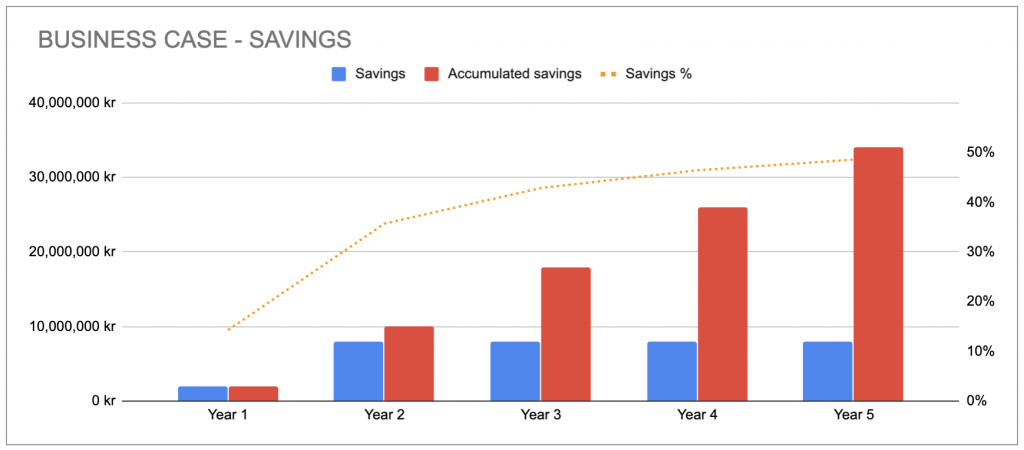

The graph below shows savings per year and accumulated savings. This company would save 2MSEK the first year and 8MSEK per year the following years. The return on investment in this example is less than a year, 10.3 months. The accumulated savings equals 34MSEK in 5 years, or 49%.

To shorten the return on investment, AWS offers generous fundings to reduce the transformation costs. Such funding is not included in this business case so there might be room for improvements.

There are of course a lot of ifs and buts in any calculation and the numbers are just interesting if you can identify yourself in them. We have created a template for helping companies calculate a comparison between keeping the existing integration platform versus a cloud based integration service from us. We can customize most of the data to simulate your specific prerequisites to make it as accurate as possible.

Please contact me or any of my colleagues if you would like to do the exercise for your company, we’re here to help.

Stay tuned for more examples of how we can help you reduce costs and increase liquidity.